Rumored Buzz on "US Bank Mobile: Secure and Easy Access to Your Accounts Anytime, Anywhere"

US Bank Mobile is transforming the way individuals bank today through providing its consumers with a convenient and reliable way to handle their funds. Along with the rise of mobile phone usage, US Bank has identified the increasing necessity for consumers to have accessibility to their profiles on-the-go. In this short article, we will definitely look into some of the function that help make US Bank Mobile stand up out and why it is coming to be a go-to alternative for many customers.

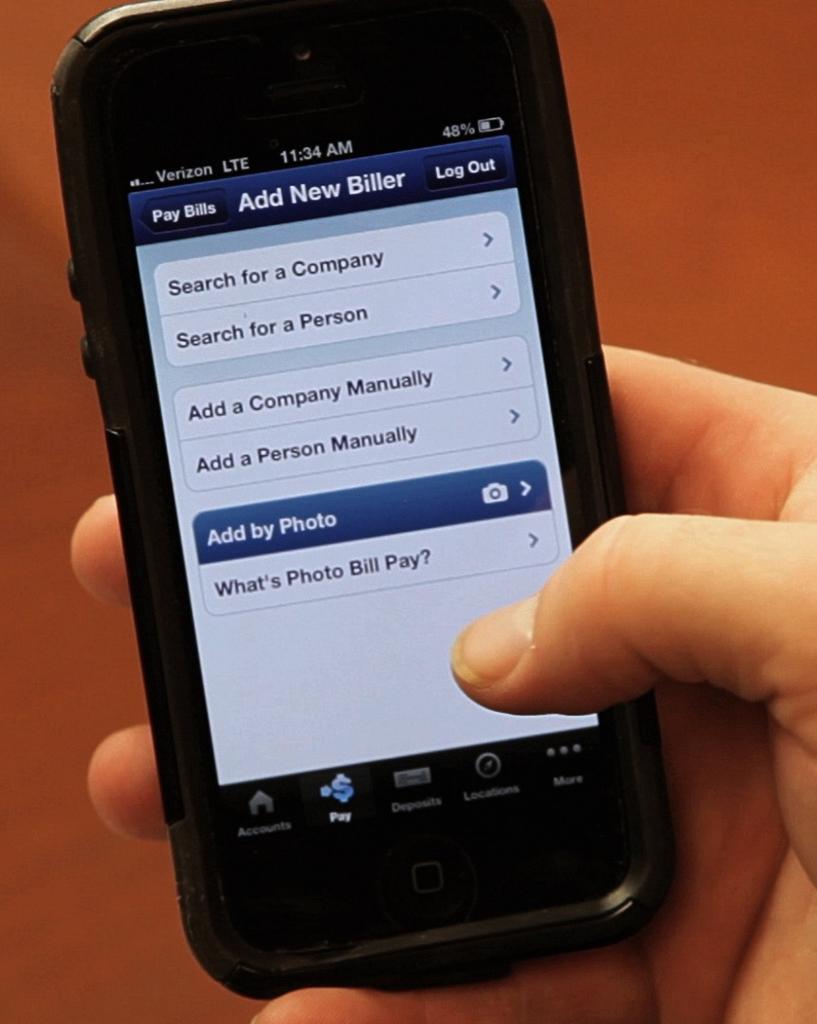

One of the most distinctive component of US Bank Mobile is its ability to do essentially all banking purchases by means of a consumer's smartphone or tablet computer gadget. Research It Here can easily view account balances, move funds between profiles, wages expenses, and even down payment examinations utilizing their mobile phone devices. This indicates that consumers no longer possess to actually see a division or ATM to complete these purchases, conserving time and making financial even more hassle-free.

Yet another key attribute of US Bank Mobile is its protection action. The app requires consumers to verify themselves making use of either Touch ID or Face ID (depending on their unit) before gaining access to their accounts. This ensures that only accredited individuals can access delicate economic details.

In addition, US Bank Mobile likewise uses real-time alerts that notify customers when certain deals occur on their profile. For example, if there is an unwarranted deal or if a harmony drops below a pointed out volume, an notification will definitely be sent out right away to the consumer's device. This helps ensure that consumers are mindful of any prospective deceitful activity on their account as quickly as achievable.

US Bank Mobile also enables for easy budgeting and monetary program by means of its Money Manager attribute. Consumers can easily sort their costs habits and set spending plans for different types such as enjoyment or groceries. The app at that point tracks costs in each group and delivers warning when the finances limit has been arrived at.

Furthermore, US Bank Mobile uses personalized understandings into a client's costs practices by means of its Spend Analysis device. This device assesses transaction past and gives insights in to where cash is being devoted each month. This function assists consumers identify areas where they may be overspending and create modifications to their budget as needed.

US Bank Mobile is additionally integrated with Apple Pay, Samsung Pay, and Google Pay. This means that consumers can easily utilize their smartphones or smartwatches to help make acquisitions at taking part stores without having to hold a bodily credit scores or debit card.

Finally, US Bank Mobile gives a feature called My Private Banker, which makes it possible for consumers to attach along with a private lender by means of the application. Consumers can inquire questions regarding their accounts or obtain monetary assistance from a proficient expert.

In conclusion, US Bank Mobile is changing the method folks bank today by providing customers with a hassle-free and protected way to handle their financial resources. With attribute such as real-time notification, budgeting resources, and personalized knowledge right into costs behaviors, US Bank Mobile is becoming an more and more preferred possibility for those who value comfort and productivity in their financial encounter. As mobile usage carries on to expand, it is very likely that even more banking companies are going to follow satisfy and use comparable solutions in order to fulfill the advancing requirements of customers.